AIA Virginia and our friends with ACEC Virginia have been working for years to address issues surrounding the Internal Revenue Code Section 179D, Energy-Efficient Commercial Buildings Tax Deduction.

Many of our firms realize significant tax savings in exchange for spending increased design time incorporating energy-efficient solutions into building designs and we’re working to preserve this benefit on multiple fronts. Beyond our efforts to get 179D extended at the federal level, we’ve been working to curb a practice that firms are encountering in Virginia.

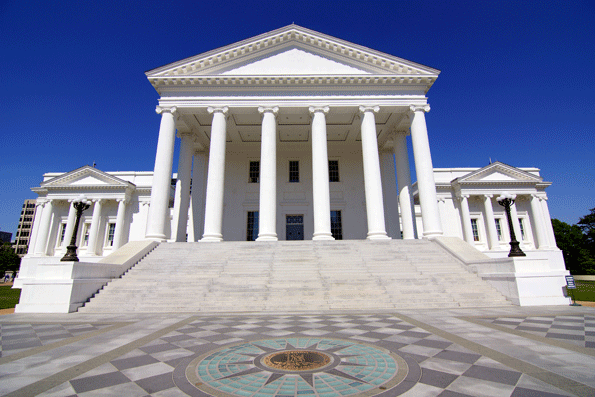

Some public bodies solicit payments or request fee reductions in exchange for signing the required allocation letter. The AIA and other stakeholders have consistently opposed this practice at the federal, state, and local levels. Last legislative session we worked to add language to the Virginia budget which would prevent a public entity from refusing to sign the allocation letter or make the signature contingent on any transfer of value from the designer to the public entity.

Though this effort failed in the end, we haven’t given up. We worked closely with AIA National, ACEC National, and ACEC Virginia to seek Senator Warner’s assistance and support in gaining more clarity surrounding congressional intent relative to section 179D of the IRC. We’re hoping for that guidance issued at the Federal level can be used to strengthen and complement our work at the state level to clarify legislative intent — and put a stop to public bodies asking for a reduced fee or “kickback” from the deduction.